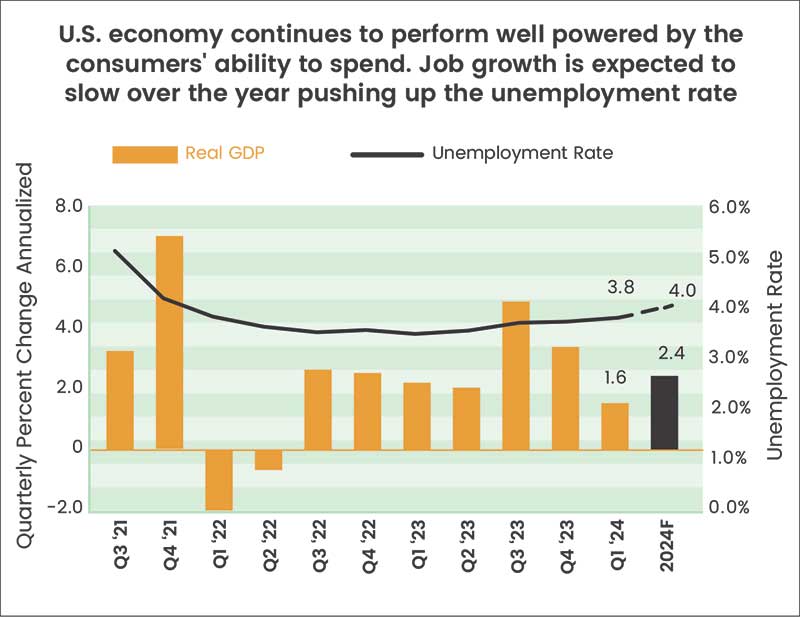

US Economy: First Quarter Growth Slows but Uncomfortable Inflation Persists

The U.S. economy expanded in the first quarter 2024 but at a slower pace than in 2023.

- Gross domestic product was at 1.6% at an annual rate, down from the 3.4% growth pace in the prior quarter.

- Unemployment was below 4% and was tracking close to its potential of 2%.

- Final sales to private domestic purchasers, a key measure of private demand, increased 3.1%, although slightly slower than the 3.3% growth seen in the fourth quarter 2023.

Elevated inflation is sticking around longer than expected.

- The price index for gross domestic purchases increased 3.1 % in the first quarter, compared with an increase of 1.9 % in the fourth quarter.

- The personal consumption expenditures (PCE) price index increased 3.4 %, compared with an increase of 1.8 % in the fourth quarter.

- Excluding food and energy prices, the PCE price index increased 3.7%, compared with an increase of 2.0% in 2023.

Consumers remain willing to spend on goods and services despite cost pressures. Growth in consumer spending slipped to 2.5% from 3.3% in the fourth quarter, even so it remains the driver of growth as it contributed 1.78 percentage points to GDP. Although the pace of spending on goods fell for the first quarter 2024, particularly in motor vehicles, parts and energy goods; spending on services accelerated like travel, financial services, and health care. Retail sales were stronger than expected in March with annual growth hitting 4% compared to the 2.1% reading in February. Some of the strong nominal retail sales gains over the last several months were partially driven by higher prices but the data still paint a comprehensive picture that the U.S. consumer remains in very good shape overall. Sales gains at food stores and restaurants signal that decent consumer demand continues.

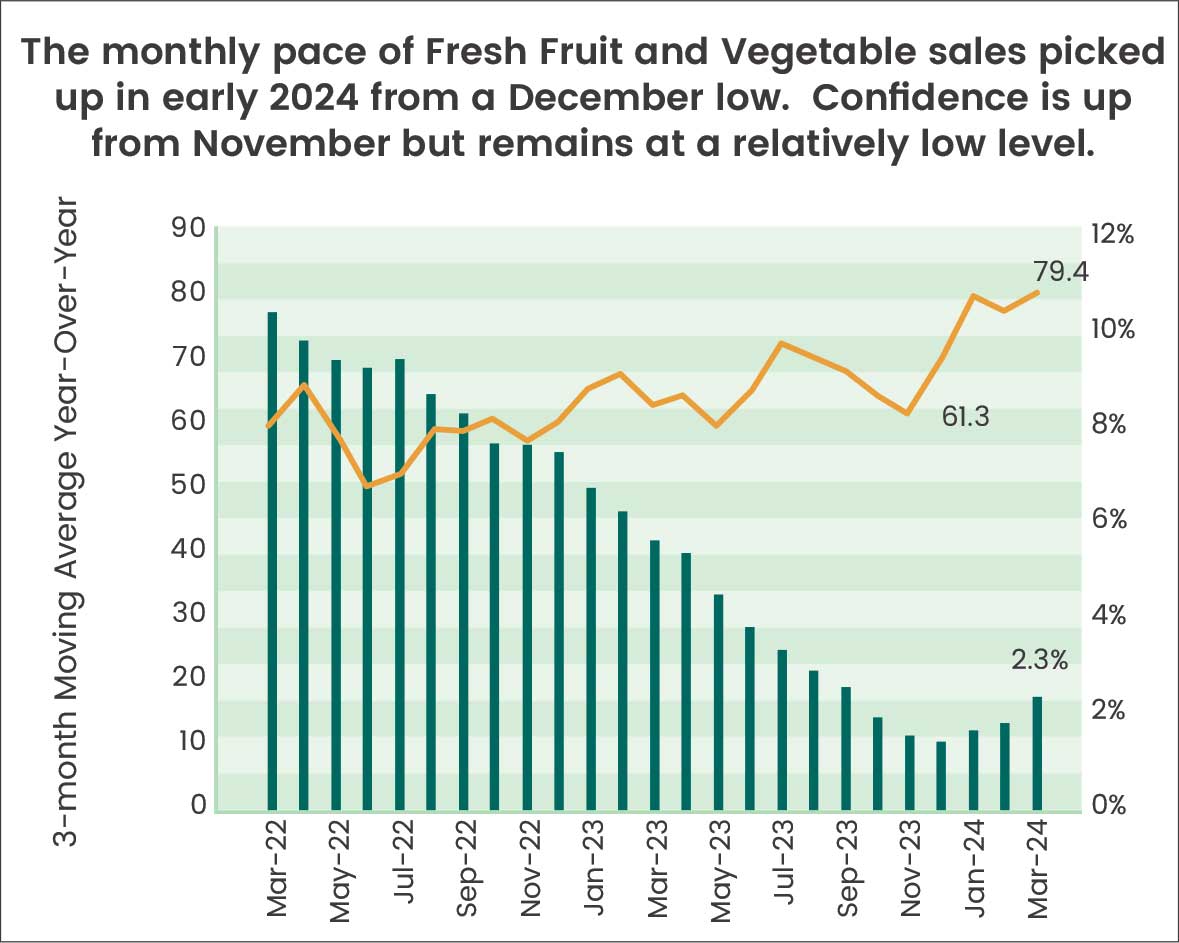

Consumers continue to spend on produce.

Fresh fruit and vegetable sales rose steadily during the first quarter averaging 2.0% on a year-over-year three-month moving average basis. This rate was greater than the prior quarter’s growth rate of 1.6 percent. Sales averaged $128.1 million for the first quarter on an annualized seasonally adjusted basis.

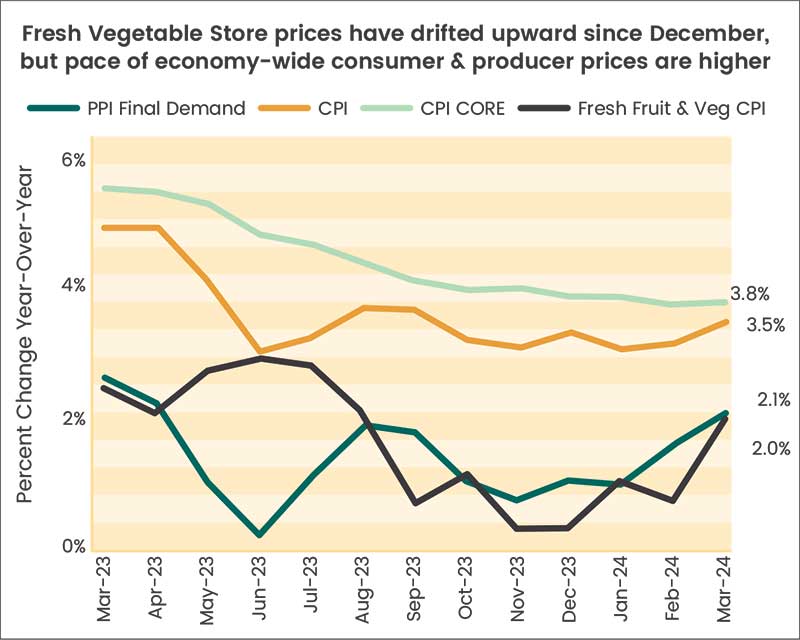

Produce inflation remains below overall inflation.

Fruit and vegetable prices at the store ended the quarter increasing 2% on an annualized basis, well below the consumer price index (CPI) that rose 3.5 % for the 12 months ending March. Fruit and vegetable price inflation has decelerated markedly from the 6-10% year-over-year rates witnessed in 2022. For the first quarter 2024, vegetable prices averaged at a 1.1% annual inflation rate and fruits a 1.2% rate- less than half the CPI’s quarterly average of 3.2%.

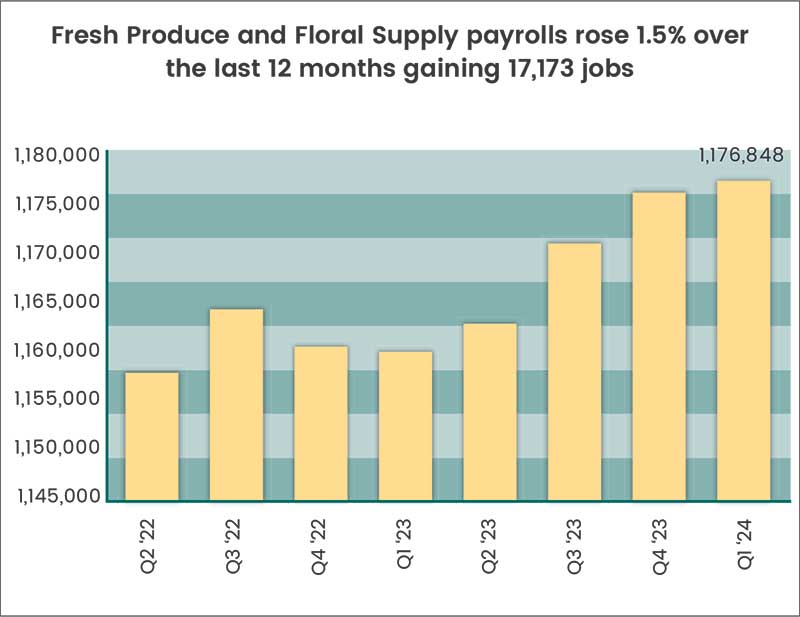

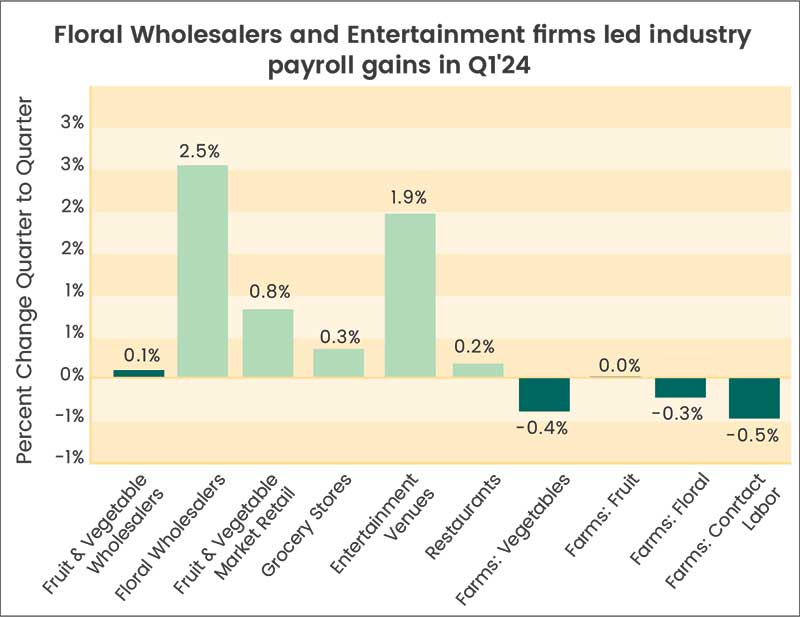

The produce industry is hiring.

Fresh produce and floral employment increased during the first quarter to 1,176,848, or approximately 1.5 % ahead of employment from this time last year.

Interest rates to remain high.

The recent acceleration in inflation along with solid economic growth suggest that the Federal Reserve will need to keep its policy interest rates higher for longer than expected. The latest Fed Beige book reported steady economic growth but little progress in reducing inflation. Previously, Fed officials expected to cut rates this year. Meanwhile, higher interest rates will put an additional drag on consumer and business pending growth.

The Federal Reserve Bank of New York’s most recent quarterly Survey of Consumer Expectations shows for the third consecutive month, inflation expectations one-year ahead remaining unchanged at 3.0%. In contrast, three-year ahead inflation expectations increased to 2.9% from 2.7%. The survey also analyzed Americans’ expectations about households’ financial situations. The expected growth in household income was unchanged at 3.1%, while household spending growth expectations point to 5.0%.

The economy benefited from an incredible labor market.

The 3-month average payroll gain reached 276,000 in March recording the fastest pace since March 2023. Despite strong overall job growth, the unemployment rate at the end of the quarter remained steady at 3.8%. Fresh produce and floral payrolls are up year-over-year by 1.5%, adding 17,173 jobs and reflects upwardly revised employment estimates from the 2022 Agriculture Census released in February 2024.

The current economic environment appears much more favorable than previously expected despite restrictive monetary policy and tighter credit conditions. Despite the dip from 79.4 to 77.2, the University of Michigan Consumer sentiment index is running ahead of its huge gains in December and January. Nonetheless, households are concerned about the high level of prices and high interest rates. As recent data continue to exceed earlier expectations, the BlueChip Economic Indicators panel of forecasters has upgraded its 2024 GDP forecast to 2.4% from its January’s projection of 1.6%. The panel projects an uptick in the unemployment rate to 4.0% reflecting a likely softening in expected job growth.